A brass Zippo lighter, manufactured in 1997, could be considered a collectible, particularly if it features a unique design, limited edition release, or commemorates a specific event. Its value might be further enhanced if it remains in pristine condition, with original packaging and inserts. Speculation on the future value of such an item constitutes the element of risk or “gamble.” This could involve purchasing the lighter with the expectation of its value appreciating over time, much like an investment.

The collectibility of Zippo lighters stems from a dedicated enthusiast community, the company’s long history, and the sheer variety of designs produced. Factors influencing a 1997 brass lighter’s worth include its rarity, condition, and potential historical significance. The “gamble” lies in the unpredictable nature of the collectibles market. While some lighters appreciate significantly, others may not perform as expected. Thorough research, including understanding market trends and consulting price guides, is essential before investing in such items.

This exploration provides a foundation for delving deeper into the world of Zippo lighter collecting, specifically focusing on brass models from 1997. Further discussion might include specific examples of valuable 1997 brass Zippos, an overview of the Zippo market that year, or tips for identifying counterfeit lighters.

Tips for Evaluating a 1997 Brass Zippo Lighter

Careful consideration of several factors is crucial when assessing the potential value and authenticity of a vintage Zippo lighter.

Tip 1: Verify Authenticity. Examine the lighter’s bottom stamp for date codes and other markings consistent with 1997 production. Consult reputable online resources for verification guides.

Tip 2: Assess the Condition. Scratches, dents, or significant wear can impact value. Note the lighter’s finish and the presence of any original lacquer. A pristine lighter commands a higher price.

Tip 3: Research the Specific Model. Certain 1997 brass Zippos might be part of a limited edition or feature a rare design, significantly increasing their value. Dedicated collector resources and price guides can offer valuable insights.

Tip 4: Inspect the Packaging. Original boxes and inserts add to a lighter’s collectibility. Their presence confirms provenance and enhances overall value.

Tip 5: Consider Provenance. Knowing the lighter’s history can add to its appeal and value. Documentation of previous ownership or any notable connections can be beneficial.

Tip 6: Consult with Experts. Experienced collectors or reputable dealers can offer valuable appraisals and authentication services. Their expertise provides objective assessments of a lighter’s worth.

Tip 7: Understand Market Trends. Collectible markets fluctuate. Researching recent sales data and auction results for comparable Zippo lighters provides a realistic understanding of current market values.

By considering these tips, potential investors and collectors can make more informed decisions, mitigating the inherent risks associated with purchasing vintage collectibles. Thorough research and careful evaluation are essential for navigating this market successfully.

These insights provide a solid basis for a deeper exploration of specific 1997 brass Zippo models and their potential value in today’s market.

1. Collectibility

Collectibility forms the foundation of the 1997 brass Zippo lighter as an investment vehicle. The desirability of these items among enthusiasts drives demand and, consequently, potential value appreciation. Understanding the factors that contribute to collectibility is crucial for assessing the potential gamble involved.

- Rarity

Limited production numbers, special editions, and unique designs contribute significantly to a lighters rarity. A 1997 brass Zippo commemorating a specific event or featuring a scarce design element becomes inherently more collectible. Rarity often translates to higher demand and increased potential for value growth.

- Condition

Preservation state plays a vital role in collectibility. A lighter in mint condition, with minimal wear and tear, retains greater appeal to collectors. Original packaging and inserts further enhance desirability. Conversely, a scratched or damaged lighter diminishes in value, regardless of other collectible attributes.

- Historical Context

The historical period of manufacture can influence collectibility. 1997 might hold specific significance within Zippo’s production history, or cultural events of that year could add to the lighter’s appeal. This historical context can make a particular year more desirable to collectors.

- Demand & Trends

Collector demand is subject to trends and market fluctuations. Certain designs or finishes might experience periods of heightened popularity, driving up prices. Understanding current market trends is crucial for assessing a 1997 brass Zippo’s potential for appreciation and the associated risk.

These facets of collectibility interact to shape the potential value of a 1997 brass Zippo lighter. Evaluating these aspects in conjunction with market conditions provides a more complete understanding of the investment landscape and the inherent risks and rewards associated with collecting these items.

2. Condition

Condition significantly influences the value and desirability of a 1997 brass Zippo lighter, directly impacting the inherent “gamble” associated with its potential as a collectible investment. A lighter’s physical state, including wear, finish, and presence of original components, plays a crucial role in determining its market value and appeal to collectors.

- Mint Condition

A mint condition lighter exhibits minimal to no signs of wear. The brass retains its original luster, and any lacquer remains intact. Such lighters command premium prices due to their pristine state, representing the ideal scenario for collectors. This condition minimizes the investment risk, maximizing potential returns.

- Used but Preserved

Lighters demonstrating signs of careful use, such as minor surface scratches or slight brass patina, fall into this category. While not pristine, they retain considerable value, particularly if functionality remains unaffected. The investment gamble here involves balancing potential appreciation against the existing wear.

- Significant Wear

Heavy usage, resulting in deep scratches, dents, or significant brass tarnishing, reduces a lighter’s value. While still potentially collectible, the investment gamble increases due to diminished market appeal. Restoration efforts might improve value but also introduce further risk.

- Damaged or Repaired

Lighters with significant damage, such as deep dents, broken hinges, or missing parts, represent a higher-risk investment. Repairs, while potentially restoring functionality, often decrease value unless performed by skilled professionals. The gamble here involves accurately assessing the cost of repair versus potential post-repair value.

The condition of a 1997 brass Zippo is inextricably linked to its potential as an investment. Evaluating condition requires careful examination and consideration of its impact on market value and collector desirability. This assessment informs the inherent “gamble” associated with acquiring these vintage lighters, shaping potential returns and influencing investment strategies.

3. Rarity

Rarity significantly influences the potential value and desirability of a 1997 brass Zippo lighter, playing a crucial role in the “gamble” associated with collecting these items. Scarcity drives demand within the collector market, directly impacting a lighter’s potential for appreciation. Understanding the factors contributing to rarity provides valuable insights for assessing investment potential and associated risks.

- Limited Edition Releases

Zippo frequently releases lighters in limited quantities to commemorate specific events, anniversaries, or popular themes. A 1997 brass Zippo issued as part of a limited edition holds greater inherent value due to its scarcity. Collectors actively seek these limited releases, driving demand and potentially increasing value over time. Examples include commemorative lighters for sporting events, historical milestones, or specific anniversaries.

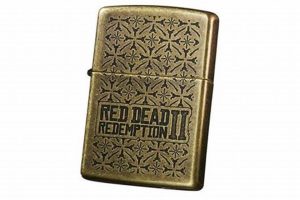

- Unique or Scarce Designs

Certain designs or decorative elements on 1997 brass Zippos might be less common than others. This could involve unique engravings, intricate etchings, or specific color combinations. Lighters featuring these scarce designs become more desirable to collectors, enhancing their rarity and potential value. An example might be a lighter featuring a particularly intricate or rare artistic motif.

- Uncommon Production Variations

Manufacturing variations, though unintentional, can contribute to rarity. This might include subtle differences in bottom stamps, case shapes, or insert mechanisms. These variations, often undocumented, create unique subsets within a particular model year, adding to the intrigue and value for discerning collectors. An example might involve a variation in the placement of a date stamp or a unique insert mechanism not typically found in 1997 models.

- Low Survival Rate

The passage of time inevitably reduces the number of surviving examples of any given item. Certain 1997 brass Zippo models might have been produced in relatively small quantities initially, and their survival rate could be further impacted by factors like damage, loss, or disposal. This natural attrition enhances rarity, increasing the value of surviving examples.

These facets of rarity collectively contribute to a 1997 brass Zippo’s desirability and investment potential. Careful consideration of these factors, in conjunction with market analysis and condition assessment, provides a more comprehensive understanding of the “gamble” involved and informs strategic acquisition decisions for collectors and investors.

4. Market Volatility

Market volatility represents a significant factor in the “1997 brass Zippo gamble.” The fluctuating nature of collectible markets introduces inherent uncertainty regarding potential returns. Understanding the dynamics of market volatility is essential for assessing the risks associated with investing in these vintage lighters.

- Economic Fluctuations

Broader economic conditions, such as recessions or periods of economic growth, can influence collector markets. During economic downturns, demand for non-essential collectibles like vintage Zippos might decrease, impacting prices. Conversely, periods of economic prosperity could see increased interest and rising values. The 1997 Asian financial crisis, for example, could have influenced collector markets globally, impacting the value of collectibles like brass Zippos.

- Collector Trends & Fads

Collector markets are susceptible to shifting trends and fads. A particular Zippo design or finish popular in one period might fall out of favor in another, impacting its market value. The “Beanie Baby” craze of the late 1990s illustrates how quickly collector markets can shift, highlighting the risks associated with relying on short-term trends. Similar trends within the Zippo collecting community can influence the perceived value of 1997 brass models.

- Supply and Demand Dynamics

The availability of specific 1997 brass Zippo models directly influences their market value. A sudden influx of a previously rare model onto the market could depress prices, while a scarcity of desirable lighters might drive values upwards. Tracking auction results and monitoring online marketplaces provides insight into supply and demand dynamics, informing investment decisions.

- Counterfeit Products

The presence of counterfeit Zippo lighters in the market introduces a significant risk factor. Fake lighters can deceive unsuspecting buyers, leading to financial losses. Authentication becomes crucial, impacting market confidence and potentially depressing the value of genuine 1997 brass Zippos.

These facets of market volatility underscore the inherent gamble associated with investing in 1997 brass Zippo lighters. While potential for appreciation exists, the unpredictable nature of collector markets necessitates careful consideration of these factors. Thorough research, market analysis, and authentication expertise mitigate risk and inform strategic investment decisions within this volatile landscape.

5. Authenticity Verification

Authenticity verification is paramount within the 1997 brass Zippo gamble. Counterfeit lighters pose a significant threat to collectors and investors, impacting market confidence and potentially leading to financial losses. Establishing a lighters genuineness is crucial for mitigating risk and ensuring a sound investment.

- Bottom Stamp Examination

The bottom stamp of a Zippo lighter provides crucial information regarding its date of manufacture and production details. A genuine 1997 brass Zippo will bear specific markings consistent with that year’s production standards. Variations in font, spacing, and depth of stamping can indicate counterfeits. Resources like online Zippo date code databases aid in verifying bottom stamp authenticity. An incorrect or poorly replicated bottom stamp immediately raises red flags.

- Case Construction & Materials

Genuine Zippo lighters exhibit specific construction characteristics. Examining the case for consistent material thickness, precise hinge mechanisms, and correct brass composition is vital. Counterfeits often utilize inferior materials or exhibit inconsistencies in construction quality. A lighters weight and feel can also provide clues regarding authenticity. For example, a genuine brass Zippo will have a characteristic heft and density.

- Insert Examination

The insert mechanism of a Zippo lighter contains further authentication details. The flint wheel, chimney, and other components should bear markings and exhibit construction consistent with 1997 production standards. Variations in these details, or the use of incorrect materials, can indicate a counterfeit. A lighters spark and flame characteristics can also provide clues regarding insert authenticity.

- Expert Consultation

When in doubt, consulting with experienced Zippo collectors or reputable dealers provides invaluable expertise. These individuals possess the knowledge and resources to authenticate lighters based on a combination of factors, including bottom stamps, case construction, insert details, and overall appearance. Their assessment significantly reduces the risk associated with purchasing a potentially counterfeit 1997 brass Zippo.

Authenticity verification directly impacts the 1997 brass Zippo gamble. A counterfeit lighter renders the investment worthless, regardless of its apparent condition or perceived rarity. Diligent authentication practices, including careful examination and expert consultation, protect collectors and investors from financial loss, ensuring that the gamble involves only market volatility and not the risk of outright fraud.

6. Potential Return

Potential return represents the ultimate driver of the 1997 brass Zippo gamble. Collectors and investors acquire these lighters with the expectation of future value appreciation. However, the actual return remains speculative, influenced by a complex interplay of market forces, collector trends, and the inherent characteristics of the lighter itself. Understanding the factors influencing potential return is crucial for navigating the risks and rewards associated with this collectible market.

- Market Appreciation

The primary driver of potential return lies in market appreciation. As demand for specific 1997 brass Zippo models increases, their market value rises accordingly. Limited edition releases, rare designs, and pristine condition contribute significantly to potential appreciation. For instance, a 1997 brass Zippo commemorating a significant historical event and preserved in mint condition might experience substantial value growth over time. However, market fluctuations introduce an element of risk, as values can decline as well as rise.

- Long-Term Investment Horizon

Collectibles like vintage Zippos typically require a long-term investment horizon to realize significant returns. Market appreciation often occurs gradually, and short-term fluctuations can obscure long-term value trends. Patience and a willingness to hold the investment for an extended period are essential for maximizing potential return. A 1997 brass Zippo purchased today might not reach its peak value for several years or even decades, requiring a long-term perspective.

- Rarity & Desirability

The rarity and desirability of a specific 1997 brass Zippo directly impact its potential return. Limited production numbers, unique designs, and historical significance contribute to scarcity and collector demand. A lighter featuring a rare design element or commemorating a specific historical event becomes inherently more desirable, enhancing its potential for appreciation. However, accurately assessing rarity and predicting future desirability require extensive market research and knowledge of collector trends.

- Condition & Preservation

Preservation state plays a critical role in potential return. A 1997 brass Zippo in pristine, mint condition commands a higher market value than a comparable lighter exhibiting wear or damage. Maintaining a lighter’s condition through careful storage and handling safeguards its potential return. Investing in protective cases and avoiding exposure to harsh conditions preserves the lighter’s value over time.

These factors collectively influence the potential return of a 1997 brass Zippo lighter. The interplay of market dynamics, collector preferences, and the lighter’s intrinsic characteristics creates an inherent “gamble.” While substantial returns are possible, realizing this potential requires informed decision-making, market awareness, and a long-term investment perspective. Understanding these factors allows collectors and investors to navigate the complexities of this market and make strategic acquisitions aligned with their investment goals and risk tolerance.

Frequently Asked Questions

This FAQ section addresses common inquiries regarding brass Zippo lighters manufactured in 1997, focusing on their collectibility and potential investment value.

Question 1: How can one determine the authenticity of a 1997 brass Zippo?

Authenticity verification relies heavily on examining the bottom stamp for date codes and other markings consistent with 1997 production. Reputable online resources and expert consultation provide additional verification support. Case construction, material quality, and insert details offer further clues regarding genuineness.

Question 2: What factors influence the value of a 1997 brass Zippo lighter?

Rarity, condition, and provenance are primary value determinants. Limited edition releases, unique designs, or lighters associated with specific historical events command higher prices. Pristine condition with original packaging significantly enhances value. Documented ownership history can also contribute to a lighter’s appeal and market price.

Question 3: Are all 1997 brass Zippos considered collectible?

While all vintage Zippos possess a degree of collectibility, certain 1997 brass models hold greater value due to limited production numbers, unique designs, or historical significance. Common models in average condition might have limited investment potential compared to rarer or pristine examples.

Question 4: Where can one find reliable information on 1997 brass Zippo values?

Reputable online price guides, auction results, and specialized Zippo collector forums offer valuable resources for researching market values. Consulting with established dealers or experienced collectors can provide additional insights and appraisals.

Question 5: What are the risks associated with investing in vintage Zippo lighters?

Market volatility, counterfeit products, and inaccurate condition assessments pose significant risks. Collector markets fluctuate, impacting values unpredictably. Counterfeit lighters can deceive buyers, leading to financial losses. Overestimating a lighter’s condition can result in inflated purchase prices and diminished returns.

Question 6: How should one store a 1997 brass Zippo to preserve its value?

Storing a lighter in a protective case, away from extreme temperatures, humidity, and direct sunlight, helps preserve its condition. Avoiding exposure to harsh chemicals or abrasive materials maintains the finish and prevents damage. Proper storage safeguards the lighter’s value and collectibility over time.

Careful consideration of these factors provides a more informed approach to collecting and investing in 1997 brass Zippo lighters, mitigating potential risks and maximizing potential returns.

For further information, explore dedicated Zippo collector resources and consult with reputable experts in the field.

1997 Brass Zippo Gamble

The exploration of the 1997 brass Zippo lighter as a collectible investment reveals a multifaceted landscape. Factors such as rarity, condition, and market volatility significantly influence potential returns. Authenticity verification remains paramount, safeguarding against counterfeit risks. The interplay of these elements shapes the inherent gamble associated with these vintage lighters. Limited edition releases and unique designs enhance collectibility, while pristine condition maximizes value. However, fluctuating market trends and collector preferences introduce uncertainty, demanding careful consideration and informed decision-making.

Ultimately, the “1997 brass Zippo gamble” necessitates a balanced approach. Thorough research, meticulous authentication, and a long-term investment perspective mitigate inherent risks. Understanding the historical context, production variations, and market dynamics surrounding these lighters empowers informed acquisitions. The potential rewards, while speculative, remain enticing for collectors and investors willing to navigate the complexities of this specialized market. Continued exploration and engagement within the collector community provide valuable insights, fostering a deeper appreciation for these enduring symbols of American craftsmanship and the dynamic forces shaping their collectible value.